The question of whether retired individuals should be entirely exempt from taxes has sparked considerable debate in recent years. Many argue that retirees have already contributed their fair share to society through decades of hard work and tax payments, and thus, should be relieved from further financial burdens. On the other hand, some believe that tax obligations should apply to all citizens to ensure a fair and sustainable economy. Let’s explore the key arguments on both sides of this discussion.

- They Have Already Paid Their Dues Retirees have spent decades working, earning income, and paying taxes at various levels—federal, state, and local. Throughout their careers, they have contributed to programs like Social Security, Medicare, and public infrastructure. Given that they have financially supported these systems for years, many argue that it is only fair to grant them relief from taxation during retirement.

- Fixed Incomes Make Taxation a Burden Most retirees rely on fixed incomes, primarily from pensions, Social Security benefits, and retirement savings. Unlike working individuals, they do not have the flexibility to earn more income to offset tax payments. Being taxed on their limited resources could lead to financial struggles, making it difficult to afford essential needs like healthcare, housing, and daily living expenses.

- Encouraging Savings and Economic Participation If retirees were exempt from taxes, they would have more disposable income to spend on goods, services, and leisure activities. This increased spending could help stimulate local economies and support businesses. Additionally, providing tax incentives for retirees could encourage younger generations to save more for their own retirement.

- Moral and Ethical Considerations Many believe that taxing retirees is unjust, as they have contributed to society for decades. Retirement should be a time of financial security and relaxation, not an additional period of stress caused by continued tax obligations. Granting tax exemptions would be a way of showing appreciation for their lifelong efforts.

- Sustainability of Public Services Tax revenues fund essential services, including healthcare, infrastructure, and public safety. If retirees were completely exempt, governments might struggle to generate enough revenue to maintain these services. This could place a heavier burden on younger, working taxpayers, potentially leading to higher tax rates for them.

- Not All Retirees Are Financially Struggling While some retirees live on limited incomes, others enjoy significant wealth from investments, properties, and substantial pensions. A blanket tax exemption would benefit the wealthy just as much as it would assist those in need, which could lead to an imbalance in economic fairness.

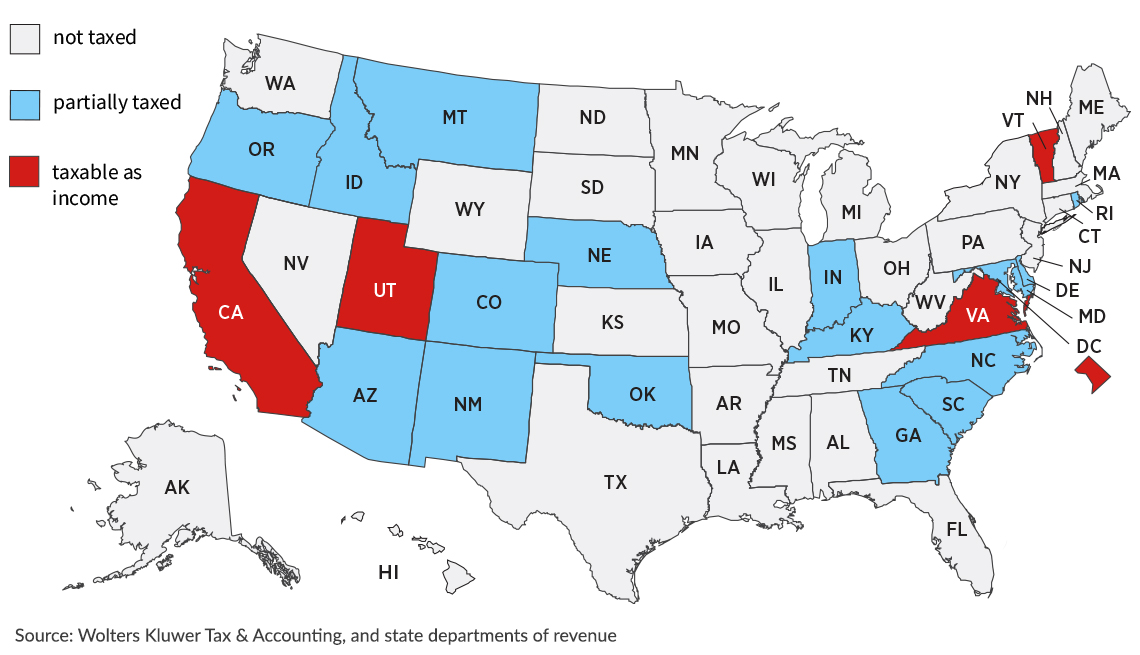

- Alternative Tax Relief Options Instead of a complete tax exemption, governments could offer targeted tax relief measures, such as reduced tax rates on retirement income, increased standard deductions, or exemptions on Social Security benefits. These measures would support retirees without entirely eliminating their tax contributions.

- Maintaining Intergenerational Equity If retirees were fully exempt from taxes, the financial responsibility of funding public services would shift more heavily onto younger generations. This could create resentment among working individuals who would have to compensate for the lost revenue, potentially straining intergenerational relationships.

While the idea of complete tax exemption for retirees is appealing, it may not be the most practical or sustainable solution. A balanced approach would involve providing tax relief to those who need it most while ensuring that retirees with significant financial resources continue to contribute. Governments could explore progressive tax policies that exempt low-income retirees while maintaining fair taxation for wealthier individuals.

Ultimately, the debate revolves around fairness, sustainability, and the role of taxation in society. While retirees deserve financial security and recognition for their contributions, any policy changes must carefully consider economic viability and intergenerational fairness. A well-structured tax system should aim to provide relief without compromising the stability of public services and the overall economy.